If I had a penny for every time I put something off until tomorrow, and never got to it… I’d put them all in a sock and hit myself with it

Read MoreMany of our Botswana-based clients have highlighted the recent surge in Gold prices

The Gold price has doubled since early 2024 and is now above US$4,100/oz. We’ve heard forecasts pointing to US$4,900/oz by 2026. This surge is driven by:

- ETF inflows of over US64 Billion in the first 9 months of 2025

- Countries like China & Russia replacing US dollar reserves with gold.

- Gold reclaiming its role as a safe-haven asset as a result of inflation fears.

Read MoreWhat is Liquidity?

Simply put - when you deposit your money in a bank, it doesn’t stay there! The bank tells us we can have our money back in the short term, but then lends it out to borrowers over terms of 3,5,10, even 25 years.

When the bank doesn’t have enough money to satisfy this months withdrawals from depositors, then they are have a liquidity problem - they must desperately scramble to attract more incoming depositors money.

Read MoreThe market cycle and trauma cycle both involve emotional highs and lows. Without proper guidance, investors risk making emotion-driven decisions that destroy wealth.

Read MoreAt SCI Wealth, we specialize in crafting personalized strategies that balance growth and security for your specific needs. Whether you’re just starting out or fine-tuning your investments, let us help you build a portfolio that’s as unique as you are.

Read MoreSmall habits—when practiced consistently—can have a profound impact on your financial well-being. Building good financial habits doesn’t need to be overwhelming. By making small, intentional changes, you can steadily work towards your goals without feeling burdened…

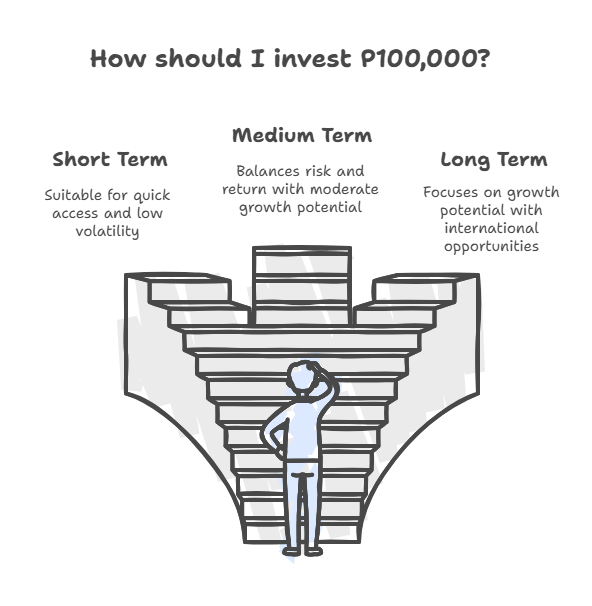

Read MoreA P100,000 pot of cash can make you an attractive return over the long term if invested well.

A diversified portfolio of stocks and funds or an ETF which tracks a major stock index can be a powerful way to grow your money over time and keep ahead of inflation.

Here we lay out what to consider before making a move and some of the options available.

Read MoreAs the new year unfolds, we all stand at the edge of possibility, looking out at the horizon of what could be. Whether you’re already among the top 1% of earners or dreaming of joining their ranks, the beginning of the year is a powerful time to reflect, plan, and take action. Financial freedom isn’t just for the privileged few—it’s a goal within reach for anyone willing to build a bridge from where they are now to where they want to be….

Read MoreBuilding wealth isn’t about chasing quick wins… it’s about making smart, consistent decisions that lead to long-term financial success. Just like planting a tree, successful investing requires patience, care, and a clear vision for the future.

Read More