Investing basics: How to invest P100,000

A P100,000 pot of cash can make you an attractive return over the long term if invested well.

Holding money in cash (preferably earning interest in a money market fund) may be the right move for some people, particularly those who are likely to need to spend it in the near future, inflation will eat away at it if not invested.

A diversified portfolio of stocks and funds or an ETF which tracks a major stock index can be a powerful way to grow your money over time and keep ahead of inflation.

Here we lay out what to consider before making a move and some of the options available.

In this article we explain:

Is investing right for me?

Is P100,000 is a good investment amount?

The best way to make the most of your P100,000

How to invest P100,000 wisely

Checklist for investing P100,000

Is investing right for me?

The decision to invest will depend on many factors, including what else is going on in your life, your financial situation and your investment goals. Here are some things you should think about before you start:

Do you have an emergency buffer? The recommendation is between three and six months’ essential outgoings in an easy access money market fund, so that you can get your hands on it when you need it.

Are you planning a big life change such as having a baby or moving house? Consider having extra cash in your money market fund so that you can access it when you need it.

How much expensive debt, such as money owed on credit cards, do you have? You may well be better off putting your money towards that to pay down your debts.

Are you about to retire soon or are you in ill health?

To mitigate volatility risk, it’s recommended that you leave your money invested for at least five years.

Investing is likely to be a good idea in the long run given that most banks are quick to lower interest rates but not so quick to put them up.

The annual rate of inflation is now at 2.5%, while you can get around 5.5% in an easy access money market fund today. But it in the recent past interest on savings was undershooting inflation, meaning the real value of money was being eroded over time. One potential way to combat this is through investing for the long-term.

If you have reached the end of this section and decided that investing ticks the boxes, read on.

Is P100,000 a good investment amount?

Yes, P100,000 is a good amount to invest. But remember: the longer you can leave your money invested, the better.

This gives it a chance to grow and ride out any fluctuations in the stock market.

What is the best way to invest money?

Here are three tips to help you get started.

1 Invest for at least five years

To give yourself a fair chance of getting a decent return, you should invest for at least five to ten years. The longer you invest your money, the more time you have to:

Accrue returns on your investment portfolio

Ride out any market downturns

Let your returns compound (grow in a snowball effect over time as returns get reinvested)

2 Choose a good financial planner or investment adviser

In Botswana, there are three types of adviser that you can choose from:

Licensed Investment Adviser

NBFIRA lists their licensed investment advisers here: https://www.nbfira.org.bw/regulated-entities-0

The advantages of using a regulated investment adviser are that (a) they are less motivated by up-front sales commission, (b) they are more likely to have investment qualifications and (c) they are likely to be independent and not tied to selling just one solution.

Insurance Agent or Broker

An insurance agent is tied to one insurance company, such a Botswana Life Insurance https://www.botswanalife.co.bw/ Liberty Life Botswana https://www.liberty.co.bw/ or Metropolitan Botswana https://metropolitan.co.bw/. This generally means that they are trying to sell you a life insurance product, rather than tailoring a financial plan to suit your needs.

An insurance broker is not tied to just one company, but may still be motivated to sell a product because life insurance plans pay up-front commission. Typically an agent of broker is paid the bulk of their commission on day one - even if your plan is supposed to run for many years.

Unlicensed financial adviser

There are, unfortunately, many unlicensed and unqualified advisers out there. They may convince you that they are somehow ‘licensed overseas’ or that they don’t need to have a license to advise you on your investments. All financial advice in Botswana is regulated by NBFIRA, and if you come across an unlicensed adviser you should report them anonymously to NBFIRA on the Toll-Free Number: 16133 or by email to: NBFIRA@tip-offs.com

3 Understand your investment

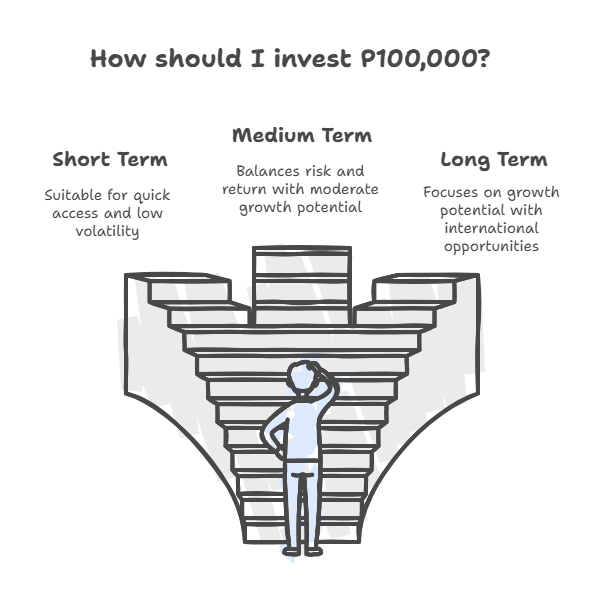

Have a clear target for your investment, and clear as to whether your target is short term (1-2 years), medium term (3-5 years) or long term (more than 5 years).

Many long term investment products have early exit charges to access money within the first few years of investing.

You may also consider using a tax advantaged product such as a retirement annuity or pension fund to protect your investment returns from the taxman.

Many investment products have the flexibility to choose your underlying investments - make sure that you are getting good, ongoing advice on this throughout the term of the investment.

Where is the best place to put p100,000?

Which solution you would choose depends on:

your investment horizon (that is, when you think you might want to cash in the investment);

how much volatility (ups and down in value) you are willing to put up with.

Short term (between one and two years):

If you are investing money and think you will need to access it this year or next year, you should consider a Money Market Fund

This is because you can access the money at whatever point you want, and the value does not fluctuate up and down.

Medium term (Three to Five years):

If your goal for your money is between three and five years away, you can consider a balanced investment fund, which may invest in deposits, bonds, equities and commodities, both locally and internationally.,

Long term (Five plus years):

Often the best way to invest P100,000 for the long term is internationally, because over the long term the Pula tends to depreciate against hard currencies such as the Dollar, Pound and Euro.

However, if you are confident that you will definitely retire in Botswana, you should also consider a retirement annuity or pension fund as these have tax advantages, in return for being locked .

How to invest P100,000 wisely

Another factor determining how you should invest is your attitude to volatility. To work this out you need to consider your “capacity for loss” and your “risk appetite”.

Capacity for loss = how much you can afford to lose

Risk appetite = how you feel about losing money

You should ask yourself these questions first:

Am I OK for my P100,000 investment to fall in value every now and then?

Do I want to try for higher returns, despite the increased ups and downs involved?

Can I resist the urge to panic and sell my investment if it falls below what I paid for it?

Can I afford to make a loss with part of my investment in the short term in order to have a better chance of long term success?

If you answered yes to the above, it sounds like you would be comfortable investing.

How to spread investment risk

Many investment experts recommend a 60/40 mix. That is an investment portfolio invested 60% in equities (company shares) and 40% in bonds.

For higher returns, an attractive investment for P100,000 could be equity funds or ETF’s. You could invest in a tracker fund that mimics the performance of stocks listed on the MSCI World Index, which is a low-cost way of investing in shares.

Remember shares have higher volatility than bonds.

A potentially good way to invest P100,000 is to diversify it across:

Different asset classes – such as shares, bonds and commodities

Different sectors and countries – such as emerging markets (for example, India) and developed countries (such as the UK)

Spreading your investments this way can help level out fluctuations or falls in prices, making it easier to weather the bad times and benefit from the good.

How do you double up P100,000?

The best way to double P100,000 is by investing for the long-term, rather than trying to get rich quickly.

Consider what returns you are looking to make and over what time period. But be realistic – you are unlikely to double P100,000 in two years.

As tempting as it might be when you see some of the promised rates of returns on high-risk products or the rise of crypto-commodities such as bitcoin, these are best avoided. That is, unless you absolutely know the risks and are happy to take them on, including the prospect of losing your entire pot.

However, given a 10% annual rate of return, P100,000 will turn into P200,000 in just 7 years.

Can you turn P100,000 into P1,000,000?

Yes, this is possible but (without taking extremely high risks and having a lot of luck), it would take decades. You’d need to compound 12% growth for 20 years to 10x your money.

A medium risk investors should probably expect an average investment growth of about 10% a year in Pula over the long term. At that rate it would take about 25 years before your P100,000 pot grew to P1,000,000.

The key here is to remain invested for a long period of time and invest in assets with a higher chance of return (such as shares) in order to grow your pot to P1,000,000.

Another tip is to drip-feed money into your pot over time to give it the best chance of growing. If you saved P1,000 each month for 25 years, and aceived a rate of return of 10% per annum, your pot would reach P1,326,000.

How to review your investments

Markets go up and down, so investors should monitor their portfolio, but should avoid making alterations unless their circumstances change, or to rebalance the portfolio.

Rebalancing might mean buying more shares when stock markets fall so as to benefit when markets bounce back.

A good financial planner will help you with regular reviews of your portfolio and counsel you on the best, forward looking, strategies.

Checklist for investing P100,000

Know your goals: Are you investing P100,000 for the long-term, perhaps for retirement, or a short term saving such as for a house deposit

Do your homework: Have a look at the track record of the fund manager or investment platform you are considering using

Diversify: Spread your cash across different asset classes, sectors and countries to level out any fluctuations in prices.

Keep it simple: A well-diversified portfolio of shares and bonds is all most investors need.

Keep a calm head: Investors have to manage their emotions. Once you’ve set up your low-cost, diversified portfolio, it is a matter of being patient and staying the course.