How a Total Portfolio Approach Can Improve the 60/40 Portfolio

A beginner’s guide to the Total Portfolio Approach for building portfolios.

Despite decades of predictions to the contrary, the 60/40 portfolio of stocks and bonds refuses to die. That has not stopped the investment industry from trying to replace it, though, usually with something more complex and expensive.

The total portfolio approach (TPA) might be the rare exception. Even as the latest industry buzzword, it offers something potentially useful for all investors. TPA offers a way to rethink portfolio construction without abandoning the familiar 60/40 framework altogether. Instead of starting with a fixed split, such as 60% stocks and 40% bonds, it begins by examining how different investments behave.

The appeal is straightforward. The goal isn’t to chase higher returns at all costs, but to build a portfolio that behaves more predictably when markets get rough. That kind of predictability matters because portfolios that hold up closer to expectations make it easier for investors to stay invested through tough periods, which is often the difference between reaching long-term goals and falling short.

The approach got a major vote of confidence in November 2025, when CalPERS, the $600 billion US pension fund, announced it would adopt the model.

What Is a Total Portfolio Approach?

At its core, TPA groups investments by risk rather than by label. The question isn’t whether something is a stock or a bond, but how it tends to act in different market environments.

This way of thinking isn’t as radical as it sounds. A traditional 60/40 portfolio is already a rough attempt at separating growth-oriented assets from those meant to provide stability. Stocks are expected to drive long-term growth, while bonds are meant to help cushion the portfolio during market downturns. TPA builds on that same intuition but tries to apply it more deliberately.

In practice, institutional TPA portfolios can be highly complex, often targeting half a dozen or more distinct risk factors. To illustrate how the idea works, look at a simplified framework with just two sleeves: Growth and Stability. These sleeves play roles like stocks and bonds in a 60/40 portfolio, but they offer a clearer picture of how different investments behave under stress.

The Growth sleeve includes investments that are expected to do well when the economy is expanding and markets are rising, but that also tend to suffer losses during downturns. Equities are the obvious example, but they are not the only ones. Assets whose returns are closely tied to economic growth and investor risk appetite belong here.

The Stability sleeve is designed to play a different role. It holds investments that are expected to hold up better, or even help offset losses, when growth assets struggle. These are the parts of the portfolio meant to provide ballast during market stress, even if that means giving up some upside in strong markets.

High-yield bonds help show why this distinction matters. In a traditional 60/40 portfolio, they sit neatly in the bond bucket. When markets get rocky, however, high-yield bonds often fall with stocks, offering less protection than investors expect from the 40% in a 60/40 portfolio.

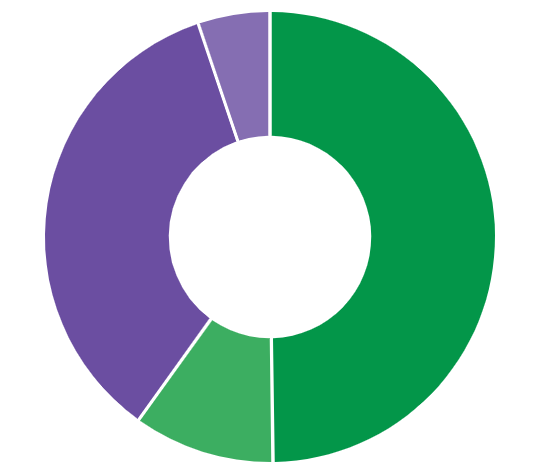

Under a Growth and Stability framework, high-yield bonds move into the Growth sleeve because of their sensitivity to economic downturns. That reclassification leaves the Stability sleeve better positioned to do what it is supposed to do: help cushion the portfolio when equities stumble. The exhibit below shows a hypothetical portfolio divided by risk, with Growth in green and Stability in purple, rather than by traditional asset classes.

How a 60% Growth and 40% Stability Portfolio Could Look Using a Total Portfolio Approach

5% Cash, 35% Investment Grade Bonds, 10% High Yield Bonds, 50% Equities

The same logic that moves high-yield bonds into the Growth sleeve can apply to other credit-oriented investments as well, including private credit, emerging-market debt, and leveraged loans. While these investments are often labeled as bonds, they tend to behave more like equities during broad market selloffs, showing higher correlations to stocks precisely when diversification is needed most.

The framework cuts both ways. Some equity strategies are designed to be less volatile and more defensive in nature. Strategies that focus on companies with a long history of growing dividends, for example, often hold up better in market downturns and may behave more like stability assets than traditional stocks. Under a Growth and Stability framework, they could reasonably fall into the Stability sleeve.

Where The Total Portfolio Approach Falls Short

The main challenge with TPA is that markets don’t follow fixed rules. TPA is built on assumptions about how different investments behave across market environments, but those relationships are not permanent. Correlations shift, regimes change, and assets that historically provided stability can behave very differently when the underlying drivers of markets evolve. In 2022, for example, high and persistent inflation led to rapidly rising interest rates that wreaked havoc on previously stable high-quality bond funds.

How Total Portfolio Approach Can Help You Build Smarter Portfolios

Acknowledging that limitation is precisely where TPA becomes useful. The approach doesn’t eliminate uncertainty or guarantee smoother returns; instead, it forces investors to be more explicit about why each investment is in the portfolio and what role it is meant to play. That discipline is especially valuable when allocating to asset classes like high-yield bonds, private credit, or other private market investments, which may look diversifying on paper but often behave more like equities during periods of stress.

Ultimately, TPA isn’t about abandoning 60/40; it’s about understanding it better and improving it at the margins where it matters most.